Another tax season in the books, YAY! Maybe you were on your game and filed early or maybe you waited until the last minute. In the end you either own money or you’re getting a return.

Unfortunately, I owned a fair amount this year. First I cried then I paid it. Good thing I know how to save. Well this got me thinking about how I’ve spent my returns in the past and how you should be spending your returns too. Just saying…

1. Invest in Yourself

Simple right? Take that money and put it right into your IRA for the following year! You’ll want to add more later and max it out, but if you have a nice chunk of change now why not just make the contribution.

2. Pay Down Debt

We’re lucky enough to be debt free [other than our house], but taking your return and paying down your mortgage, college loans, medical bills, credit card, etc. is a great investment. Just think you’ll pay less interest in the long run and be closer to being debt free!

3. Contribute to Your Child’s College Fund

Emerson had a college fund before she was born. Why? Because we want her to go to college and not have to worry about loans after graduation. Neither Nick or I had college loans and we don’t want Emerson to either! Don’t have children? See other ways to spend your refund.

4. Deposit Money to your Savings

You want to have a ‘rainy’ day fund. How do you think we paid for Emerson’s time in the NICU last year?! Saving today for tomorrow.

There you have it four ways I think you should spend your refund! Yeah new clothes are fun, but I’ve always believed in paying yourself first and then eat well and travel often!

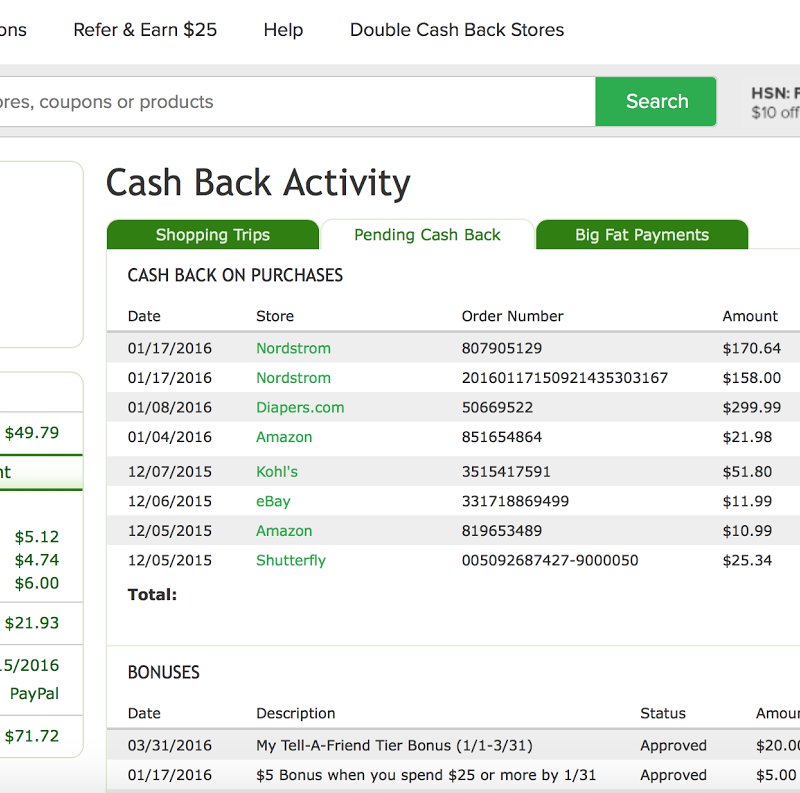

Agreed! Totally. We are also balancing paying down the last bit of debt we have other than house (my car), saving for retirement, saving for emergencies, and making sure our day-to-day bills are met. Since we started doing that, it's easier to see the Big Picture goals and not be tempted by all those random sales. We also save (using the Envelope System) for travel and whatnot since we want to enjoy now too, but when you have a chunk of change like a return, it's totally an opportunity to make a big investment in yourself.